The Importance of Proper Program Placement Group Rating Vs. Group Retro Program

Spooner Inc., has partnered with Virteom to engage our customers and users about our services and the technology behind the scenes. In our video series, Jacqui and Joe talk about what Spooner Inc., does and how it all works! This video is all about our program placement and getting the best placement for customers. Watch or read the transcription below!

What is Spooner's Program Placement?

Everything has to start with an AC3 form which is a temporary authorization, it allows us to give a company quote. There's no obligation or cost to it, but once we have that we're able to take a screenshot of a company's history and then see what's a good fit for them.

There are two main programs that exist. The first is our group rating, this is an upfront discount. It's like you're safe drivers discount. Essentially, if you have not received any speeding tickets in a while, we'll give you a little bit of a cheaper rate.

What is the Group Retrospective Program?

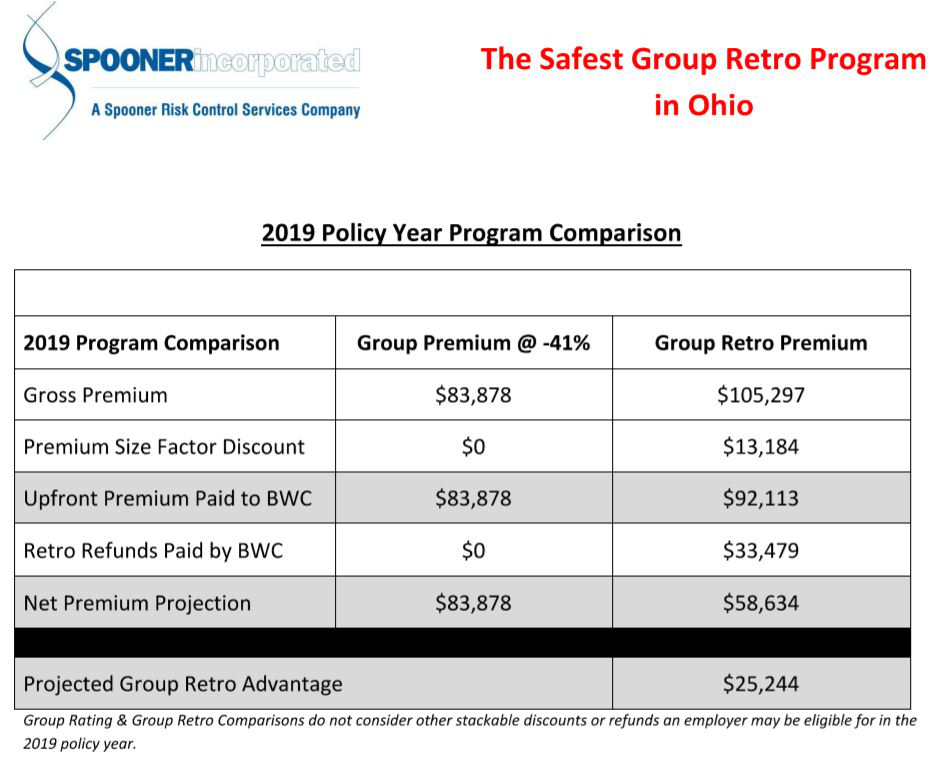

Group retro is when you've had a couple of speeding tickets, but they monitor your driving to ensure you're a safe driver, so this puts more pressure on your driving performance. Based on your performance you can get refund checks. That's what the group retrospective program is. Below is a diagram to show you how it breaks down.

Determining Your Rating and How It Plays Out | An Example

On the left under group premium, it says 41 percent. Now, the most you can get in group rating is 53 percent. That is the safest of safe drivers if you will. That 41 percent is a pretty good average, it's not bad.

When I talk to companies about what they're looking at in terms of group rating if you're getting over 40 percent it's hard to walk away from because it's pretty close to guaranteed.

But that's all you're going to get. You're going to get that $83,000. So, it's kind of guaranteed as long as no other companies that maybe came from a different situation and had some claims that people didn't know about get slid into that group.

How Safe a Driver Are You? Claims Management & Performance Based Rates

On the right, you're looking at the group retro premium and you're going to end up paying more up front - that's that $105,000. This is the performance based one (group retro). In this situation, you're going to pay more upfront then based on how you and the rest of the group you're in performs from a claims standpoint. It really does ultimately boil down to how safe they are.

Some of the other factors that they consider in claims management is how well are those costs mitigated. You can end up getting more in refunds and there's a premium side factor discount, which is something we'll go over in another video blog with you guys. But essentially, if you have a certain size and you're not participating in group rating, you're going to get an upfront discount. For this company it was $13,184.

The upfront premium paid comes down to $92,000, and then you look at those retro refunds paid and what we generally are forecasting for our clients is about 40%.

That's not guaranteed because the group has a bunch of catastrophic claims. You're not going to necessarily see those refunds, but if they perform well and at the conservative number that we put, $33,000 is a very attainable number. You take that off of there and you're going to have to wait a few years down the road until you get those refund checks. However, you could end up looking at a net premium of $58,000, which is $25,000 in the good versus the $83,000.

Spooner Evaluates Your Unique Situation to Determine the Right Program

The company in this example is an actual client of ours. They did go with group retro, but this is something we try to go through with our clients and let them know they have options.

It's not just us mailing out a quote. Take a look and let us walk through it with you and see which one makes sense for your business. Rather than taking a look at a bunch of quotes and just trying to you know pick based on price, make sure that you're going with the option that's right for you and for your company.

Joe over at Spooner is the man to help you out if you want to know your options for program placement. Contact us today or request a free quote. We’ll be sure to sit down and meet with you to see what program is right for you!