News and Updates

Category: General

Are Ohio Employers Required to Provide Time Off to Vote?

The short answer is yes, but here are some additional details that may answer any lingering questions. Ohio Revised Code (O.R.C.) Section 3599.06 provides employees a “reasonable amount of time” away from work to perform their civic duty of voting on election day. This is a bit subjective, so take into consideration whether or not there have been long lines during previous elections in your area. Most employees don’t need a whole day, or even a half day. Plan on giving some extra cushion for employees who may not live near your worksite, as their polling location will likely be closer to their residence. Additionally, O.R.C. states that employers may not: • terminate or threaten to terminate an employee for taking reasonable time off to vote • refuse to allow an employee to serve as a poll worker on election day • insist that an employee accompany them to a polling location • use any indirect force or threats to prevent staff from voting or compel them to refrain from voting Employers are not required to pay hourly employees for this time away, but also may not deduct voting time from hours worked for salaried

OSHA Renews Focus on Crystalline Silica for Some Industries

OSHA is supporting their National Emphasis Program (NEP) on respirable crystalline silica with an initiative focused on manufacturers and wholesalers of brick, stone and related construction materials (NAICS codes 327991 and 423320). This prioritizes inspection efforts for employers in these industries, with each area office in Regions 1- 8 required to perform a minimum of five programmed inspections over the next 12 months. Region 5 encompasses all of Ohio, and Ohio itself has four regional offices (Cleveland, Columbus, Cincinnati and Toledo) spanning the state. Respirable crystalline silica is 1/100th the size of a grain of sand, and exposure to it has been linked to silicosis, obstructive pulmonary disease, cancer, and other lung diseases. OSHA Administrator Doug Parker stated that workers in the aforementioned industries are reporting severe difficulty breathing, which limits their ability to work, at times resulting in total disability, or even fatality. The initiative also gives authority to local and regional OSHA offices to develop local or regional emphasis programs if they’re justified by relevant data. If you have questions or concerns about your company’s compliance with the Respirable Crystalline Silica standard, contact your Spooner safety rep, or Spooner’s safety department at

Is Your Open Enrollment Process Coordinated or Chaotic?

There’s a good chance your company is using an electronic benefits module provided by your payroll processor to handle enrollments, deductions, and payments. These add-ons make enrollments a breeze and should automate a great deal of the employee communication, meaning HR isn’t tasked with reaching out to employees who haven’t completed enrollment, or who have a discrepancy in their enrollment choices. All of these applications are designed with most of the same features and capabilities. Not unlike the payroll processor itself – the differences are usually noticeable in the level of service, support, and communication the employer receives. Employee benefits are often a major pain point for HR and management teams. They’ve already been mulled over for months by the time employees receive enrollment materials. The enrollment window is very time-sensitive, and communication between the employer, their broker, carriers, and payroll provider are essential during this timeframe. Typical enrollment windows are between two and four weeks, so any delays responding to employee issues or questions during enrollment can make things more chaotic than usual. If communication (either electronic or human) has been a problem in your past open enrollments, consider examining the source of the problem – and how much you’re being charged by your payroll processor for a service that may not be a strong point for them. If having your ow

2024 Group Rating & Group Retro Enrollment

If your business isn’t enrolled in a savings program for the coming 2024-2025 BWC policy year, you’ll want to get the ball rolling ASAP! Two of the most highly-favored programs are Group Experience Rating (usually called Group Rating, or just “Group), and Group Retrospective Rating (often referred to as Group Retro or Retro). They’re both great programs that can boast savings over 50% for some policyholders, and the difference between them is fairly simple. Group Rating is like a coupon – you receive the discount upfront, and pay lower premiums throughout the year. The maximum discount is 53% off of BWC’s base rates, which only applies to policies with zero or very few losses in their experience period. Group Retrospective is more like a mail-in rebate. You pay the sticker price to BWC for premiums, and are rebated following the end of that policy year based on how your pool performed. Refunds can total close to 50% under the most optimal conditions. Something to keep in mind: TPAs can advertise any Group Retro refund up to and including 63%, even if their pools have never achieved that. A maximum refund is uncommon, and nearly unheard of over the last couple of years due to eroding refunds due to changes within BWC. Recent changes have us hopeful that the program will begin yielding better refunds, but even still - a 63% refund in Group Retro is only achieved if there were no losses within that

Updates to OSHA Recordkeeping & Reporting

Beginning January 1, 2024, OSHA will require employers in certain high-hazard industries with over 100 employees to submit data from Forms 300 and 301 in addition to their 300A by March 2 each year. For those not familiar, Form 300 is a log of work-related illnesses and injuries, and Form 301 is a corresponding form with incident reports that should match up with Form 300. OSHA will also be updating NAICS codes used in Appendix A, which lists the industries required to submit Form 300A. They’ll also be adding an Appendix B, which will state the industries required to now submit Forms 300 and 301. OSHA administrator Doug Parker stated in a press release that this is a big step in helping the administration understand the safety and health problems that workers face. He noted that OSHA will use the data for “interventions involving strategic outreach and enforcement to reduce injuries and illnesses in these high-hazard industries.” If you have questions or concerns about OSHA reporting, or your organization’s safety policies and procedures, please contact Spooner’s safety team at

2 Hour Safety Training Deadline

If your company participated in Group Rating or Group Retro during the 2022 policy year (July 1, 2022-June 30, 2023) and had a claim during the green year(s), you’re required to complete two hours of safety training by June 30, 2023. Please be sure to complete and submit the training certificates to your team at Spooner (or your TPA, if you’re not a Spooner client). If you’re unsure if you need to complete this training, reach out to your client services manager. The training doesn’t have to be completed in person – so there’s still time to meet the requirement by participating in one of BWC’s online courses. Here are some details on fulfilling the two-hour training requirement, per the Ohio BWC website. Two-hour Training Options A variety of training sources are available for you to fulfill this requirement. They include the following offered through BWC’s Division of Safety & Hygiene: Education and Training Services Center courses Ohio Safety Congress & Exposition (OSC) safety education sessions Safety council seminars, workshops, or conferences featuring a safety topic that are at least two hours long (Safety council monthly meetings do not qualify.) Guidelines for courses offered through non-BWC training forums The group sponsor, third-party administrator, or an independent source can sponsor a course, provided it meets the two-hour criteria. The topic must be workp

Red Flags in Workers' Comp Claims

One of the things our team prides themselves on is identifying potential issues early on in workers’ compensation claims. Some of these can be so obvious that the employer will clue us in during the initial contact, but some are a bit more nuanced – and that’s where our expert claims examiners come in. Most people handling workers’ comp for a business know that a Friday afternoon or Monday morning injury is a little suspicious, even more if there were no witnesses. However, there are other scenarios that employers may not consider relative to the validity of a claim, and it’s our job to gather that information and educate our clients on how to handle it. Here are a few examples of details that sound our alarms, both early on in the claim, and as it progresses. Claimant is hostile about answering any questions regarding the accident, or provides very vague answers. Immediate representation by an attorney. The details (like date, time and place of accident) are unknown or can’t be recalled. Late reporting of the injury. Not everyone seeks medical treatment right away, but an incident report (with witness statements) should be completed even if first aid isn’t needed. The statute of limitations in Ohio is 12 months from DOI. If witness statements don’t corroborate the claimant’s story or are all different, that could be another red flag. Claimant can’t be reached - never answers the phone, or a

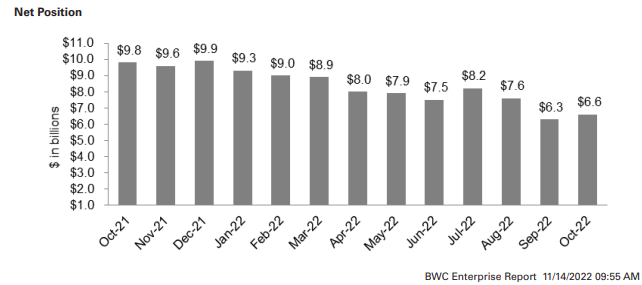

MCO Open Enrollment Wrap Up

We’d like to sincerely thank all of the Ohio employers that chose Spooner Medical Administrators, Inc. (SMAI) as their MCO during MCO Open Enrollment last month, as well as those loyal clients who chose to remain with our MCO. SMAI continues to experience sustainable, organic growth, thanks to the partnerships we have with Chambers of Commerce, trade organizations, associations, and simply by word of mouth. SMAI has grown in both policies assigned and claims managed, and was also one of only four MCOs to see a net growth during Open Enrollment. They've also been the only MCO to grow every Open Enrollment since 1997. The team at SMAI is excited to begin building partnerships with the hundreds of new employers that moved to Spooner Medical Administrators this year. Thanks for putting your faith in us, Ohio businesses! We can’t wait to meet even more new customers when the next Open Enrollment rolls around in

2023 EMR and Rate Publication

Along with the potential base rate increase we discussed in another article, Ohio employers will soon be receiving additional details for the 2023 policy year. Sometime over the next 60 days, businesses will get a letter from BWC confirming EMR and Group Rating discounts effective 7/1/23. Most businesses assume whatever Group Rating discount they were offered when they signed up over the summer and fall of 2022 was locked in, but that’s not the case. Group Rating is never a guarantee - the number you’re given is always an estimate. Your Experience Modification Rate (EMR) impacts rates, program eligibility, and for some companies – the success rate of RFPs. General contractors and large corporations (like GM, Honda, AK Steel, etc.) will often require subs or anyone working on their property to maintain an EMR of 1.0 or lower. While the EM Cap program will lower your published EMR to 0.99, those with industry experience often know that it’s not organic. If a high EMR is affecting your company’s success, there are more cost-effective options outside of EM Cap and other BWC programs. Please reach out to our team of experts if you have any questions or concerns when receiving these notifications from

Do I Need to Hire a Safety Professional?

It’s always important to have an easily-accessible and competent safety management resource, whether it’s a full-time member of your staff or a trusted third-party consultant. For some companies, an internal Safety or EHS Manager is just as essential as their Operations or Finance Manager. Other companies, such as those in relatively low-hazard industries, can sometimes get away with assigning safety as a secondary duty to internal staff. Those multiple-hat-wearing employees should have a decent grasp of basic safety management concepts and a solid understanding of the OSHA standards applicable to their operations. They will often seek the expertise of, and work in tandem with, a third-party safety consultant for periodic efforts such as compliance audits, program development, OSHA inspection assistance, or anything else that might be out of their wheelhouse. If you’re considering the addition of a safety professional to your team, the list below might help shed some light on your situation. Or, maybe your company is one of many that hasn’t yet realized that this applies to you! Either way, take a moment to reflect: Consider your size and industry: companies with 200+ total employees – especially in a higher-hazard industry, such as in OSHA’s list of NAICS codes covered by the Injury/Illness Recordkeeping Rule – should already have an internal Safety Manager. The hazards posed to empl