Blog

Why is it Important to Understand Group Retro Ratings?

Group retro is a relatively new incentive program designed to help Ohio employers keep their workplace safe. In 2009, the Ohio BWC created group retro, and since then it has worked exceptionally well for employers who either do not have a group rating option or that have the opportunity to get more premium back from this program. However, there have been some changes made to the rules and regulations that structure the group retro rating that can affect Ohio employers.

Understanding Group Retro

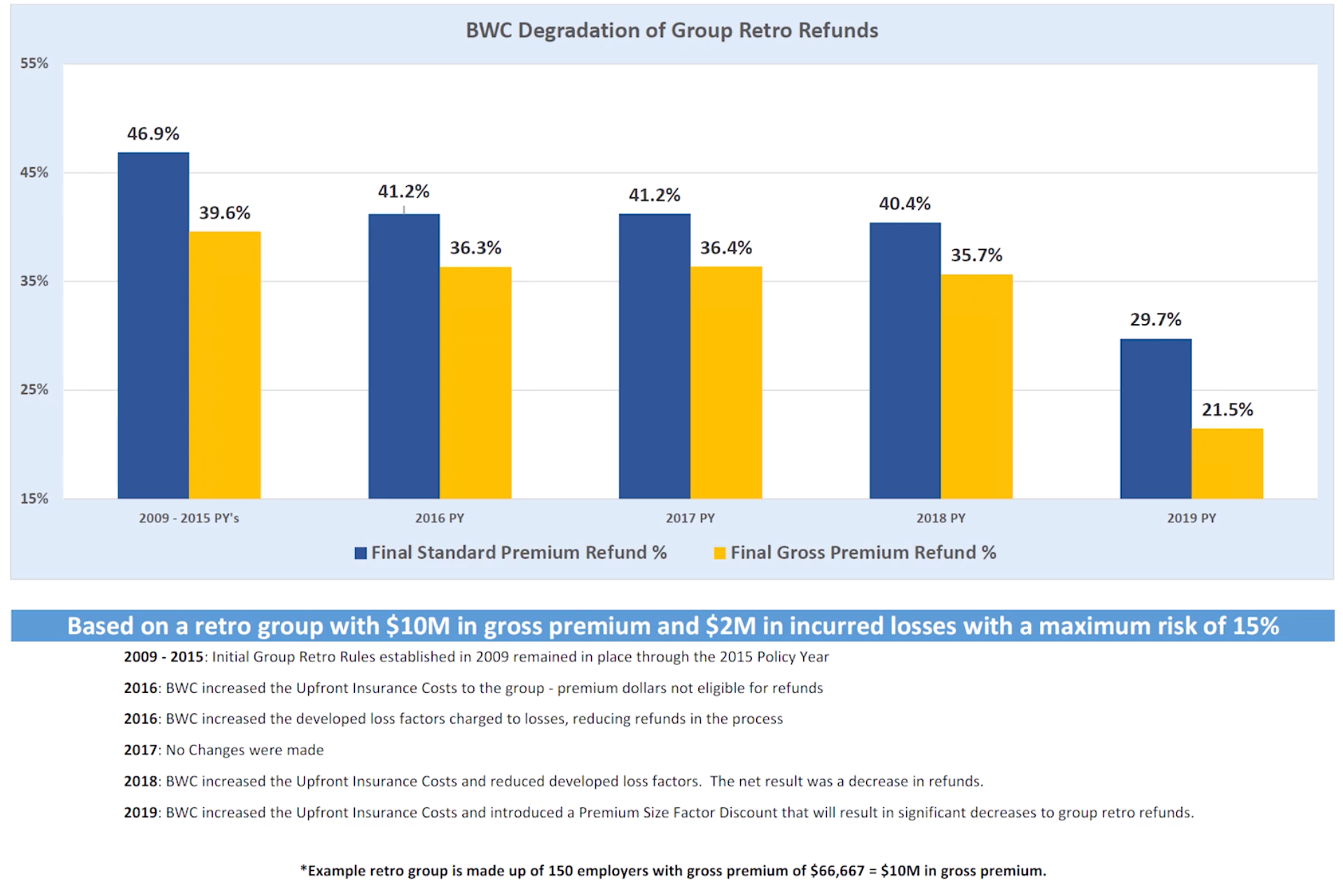

The first this that you, as an Ohio employer, need to understand is what the percentages of refunds are in the group retro program. In the graph, you can see the blue columns represent the standard refund. The standard refund is based on your premium minus the BWC admin fee.

If your company pays $100,000 in premium, the BWC admin fee is roughly $15,000, so that is an $85,000 refund.

The yellow columns represent the premium that is actually paid. This is a more accurate representation of the refund you will receive from the group retro program.

This is why it is important to know if any projection is a standard or gross refund. Otherwise, you may be left thinking you would get a larger refund than you actually will.

How has Group Retro Changed in 2019?

When it comes to the 2019 policy year, the BWC has been giving some upfront discounts for premiums, which is a good thing for some. However, this will also affect group retro employers because the amount of premium in the pool will lower. Most group retro pools have a standard loss run, or they are going to assume losses. This ultimately leads to you not getting the same percentage as before.

It's very important to make sure when you're evaluating group retro, that you understand these changes and how they will affect you. You need to understand where the percentages are projected to be and what they will actually be.

There is a lot to keep up with as the rules and regulations are always changing. That is why Spooner is here to help Ohio employers stay on track and know exactly what they are doing with their group retro refunds. If you have any questions, contact us at Spooner Inc. today or visit our site for more details.

DOL Issues Final Rule on Independent Contractors

Posted By Brandy King

January 17, 2024

Category: DOL, Independent Contractors, Ohio Bwc, Workers' Comp

Who’s Really an Independent Contractor? DOL Finalizes New Rule Clarifying Classification Earlier this month, the U.S. Department of Labor (DOL) finalized its rules regarding classification of independent contractors. The organization hadn’t previously defined this by regulations, only by guidelines (which are as clear as OSHA “best practices”). The updated rule creates a six-factor “economic realities” test to determine whether or not a worker is truly an independent contractor under the Fair Labor Standards Act (FLSA). Among others, the test includes factors such as degree of permanence, amount of control the employer holds, and the worker’s skills. Since Ohio employers aren’t required to cover 1099 employees under their BWC policy, we have a lot of discussions with clients about whether or not a worker actually meets the qualifications of being an independent contractor. Understanding these qualifications is not only important for insurance purposes, but also for recordkeeping, and the application of minimum wage and overtime rules. Our friends at Roetzel & Andress have done a great job of explaining this new classification rule in a way that’s easy to digest and understand, so we’re deferring to their recent update for the details. For more info on how independent contractors can impact your Ohio BWC policy, check out this blog. This goes into effect March 11

A Guide to Submitting 2023 OSHA Logs

Posted By Brandy King

January 17, 2024

Category: OSHA, Electronic Recordkeeping, Form 301, Form 300, OSHA 300A, Safety, Incident Reporting, Compliance

It’s time to post and electronically submit your OSHA logs - and this year, submission requirements will impact far more U.S. employers. We discussed this in detail when the rule was finalized in July 2023. Effective January 1, 2024, OSHA will require employers with over 100 employees in certain high hazard industries to complete electronic records submissions of Forms 300 and 301, in addition to Form 300A. These are records that covered employers should already be keeping, but previously have not been required to submit. The impacted industries include (but aren’t limited to) retail, wholesale, performing arts, manufacturing, farming, and grocers. Our safety team agrees that the fastest, easiest way to find out your company’s submission requirements is to use this ITA Coverage Application. Enter your company’s NAICS code and employee count, and it will confirm which logs should be submitted. As a general guide: 20-249 employees and on this list must submit 300A 100 or more employees and on this list must submit the 300A, 301 and 300 log. Employee count is “per establishment,” not entire corporation size. So, what is OSHA’s definition of an “establishment?” An establishment is a single physical location where business is conducted, or where services or industrial operations are performed. For activities where employees do not work at a single physical location - such as construction, transportation, communication

Grading Payroll Providers on Enrollment and W-2 Performance

Posted By Brandy King

January 17, 2024

Category: Payroll, Overcharging, Additional Fees, Surety HR, SI PEO, Payroll Processing Fees, ADP Fees, Paychex Fees

With 2023 group health enrollments behind us, and W-2 season wrapping up – most employers have a strong opinion about the role their payroll provider played in both of those, good or bad. Let’s consider open enrollment first. If your payroll provider utilizes an electronic benefits module, and made an implementation plan with your broker – things should have gone smoothly. Benefits enrollment is always subject to hitting snags throughout the process. Here are some things to consider: • Was there communication between all parties if a timeline changed? • Was everyone pulling in the same direction, without making you (the employer) an unnecessary go-between? • Was every party involved invested in making sure things were done right the first time? • Have you considered an API connection or Data Bridge with your Carrier? (Fees may apply) It’s important not to over- or under-rely on technology. Let the electronic benefits modules do their job, but make sure you and your payroll provider have your eyes peeled for potential issues. W-2 season brings similar headaches. If the employer has done their best to ensure that all employee info is up-to-date and accurate, the prevention and resolution of those headaches’ rests heavily on your payroll provider. If employees have questions about W-2s, or there’s a potentia

Contact

28605 Ranney Parkway

Westlake, Ohio 44145

Phone: 440-249-5260 ext. 153

Hours: 8AM to 5PM