Changes to the Ohio Bureau of Workers' Compensation for 2019

Spooner Inc., has partnered with Virteom to engage our customers and users about our services. Giving you the “behind the scenes” of how we help business owners and employers. In our video series, Jacqui and Joe talk about what Spooner Inc., does and how it all works! This video is about all of the changes the Ohio Bureau of Workers’ Compensation has coming in 2019. Watch or read the transcription below!

We work a lot with the Ohio Bureau of Workers’ Compensation and in 2019, there are some changes that may affect employers and your clients.

What’s the Deal with Billion Back?

A lot of employers have seen the billion back refunds that have gone out four of the last seven years now. I think, in an attempt to battle that discussion of “why are you able to give a billion back”, the bureau is starting to give some discounts upfront to employers. They wanted to help out employers specifically that aren't getting group rating, an up front discount for safe drivers, was discussed in our previous video. So, if you're not getting that credit-rated upfront discount, through a TPA, then what the BWC wants to do is give other discounts that will prevent that.

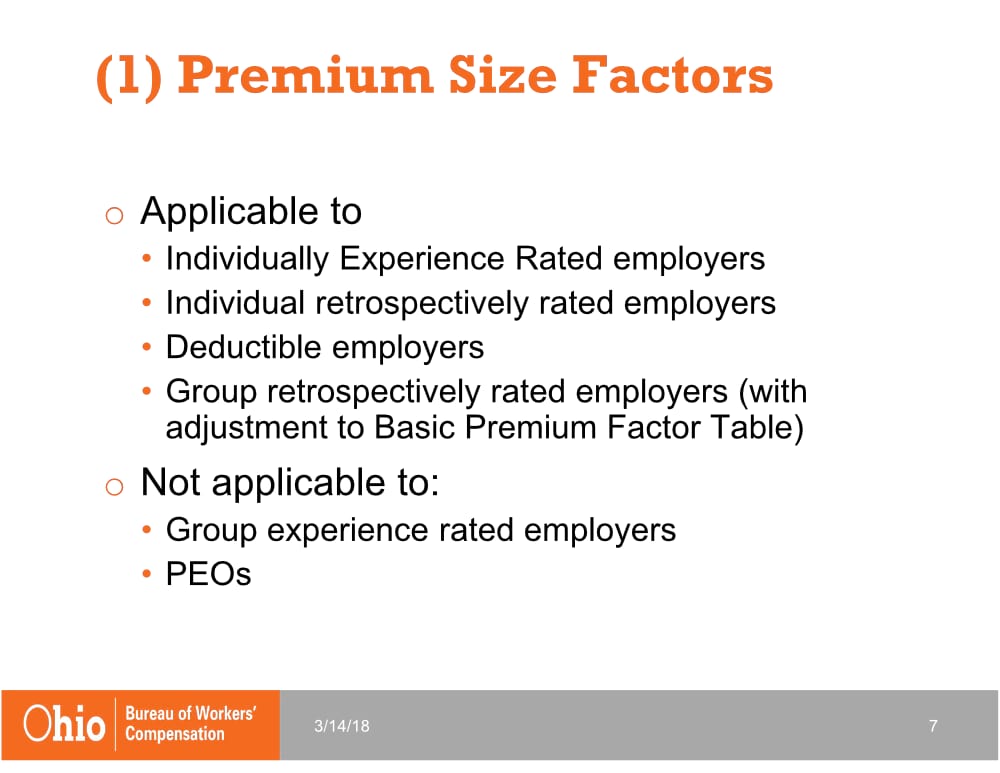

Premium Size Factors

This is applicable to anybody that's an individually rated employer - someone who doesn't have any programs they're participating in or doesn’t work with a third party administrator. There's individual retrospective-rated employer, which there aren't a lot of those out there anymore, but there are some people that still utilize it.

This is applicable to anybody that's an individually rated employer - someone who doesn't have any programs they're participating in or doesn’t work with a third party administrator. There's individual retrospective-rated employer, which there aren't a lot of those out there anymore, but there are some people that still utilize it.

There's the deductible employers who pay exactly what it sounds like - a high deductible, the initial claims costs. Then they end up letting the bureau pick up the bill. Then, finally, the group retrospective employers, which is the vast majority of these. This will not be applicable to anybody in group rating or anybody that's working with a PPO.

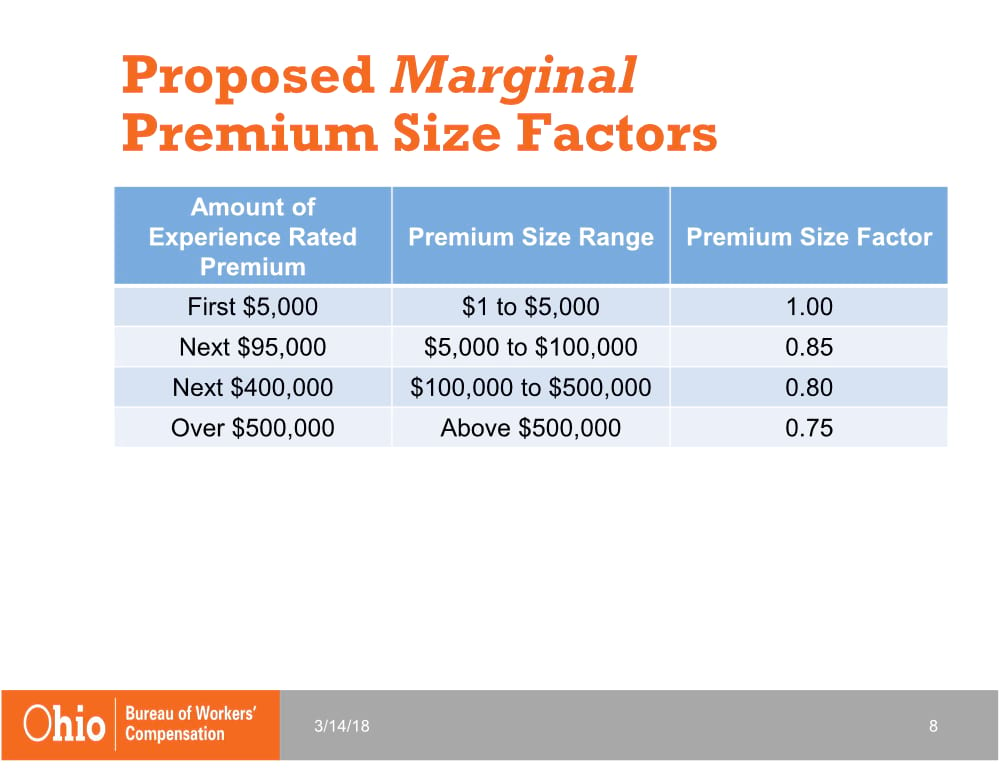

Proposed Marginal Premium Size Factors

Referencing the visual, the premium size factors work almost like your taxes. The first $5,000, if you look far to the right it says 1.00, you're going to pay it exactly on the impact the $5,000 would have on your premium.

Referencing the visual, the premium size factors work almost like your taxes. The first $5,000, if you look far to the right it says 1.00, you're going to pay it exactly on the impact the $5,000 would have on your premium.

If you look at the next $95,000 — $5,001-$100,000, they're going to give you a 15% discount on that premium. $100,000 to $500,000 is a 20% discount, and over $500,000 you're going to see a 25% discount.

Is Your Company Large Enough to Take Advantage?

If you're paying over a half million dollars to the bureau, you could initially see a 25% discount right off the bat. It's very significant, especially if you're an employer that's very large, you probably should be looking at self-insurance because you're pretty big.

But the other thing is that if you're not that large of a company, you should definitely be considering group retro because you can get that 25% discount and then still get those retrospective refunds a few years later.

These are being applied to employers regardless of if they work with the TPA. Unfortunately, we'd love to take credit for these but we can't. Joe would also tell you that Spooner has seen some of our competitors taking some credit for these and projecting it in their quotes that it's part of their savings. When, in reality, it is the bureau and that's who's ending up ultimately giving it back to the employers.

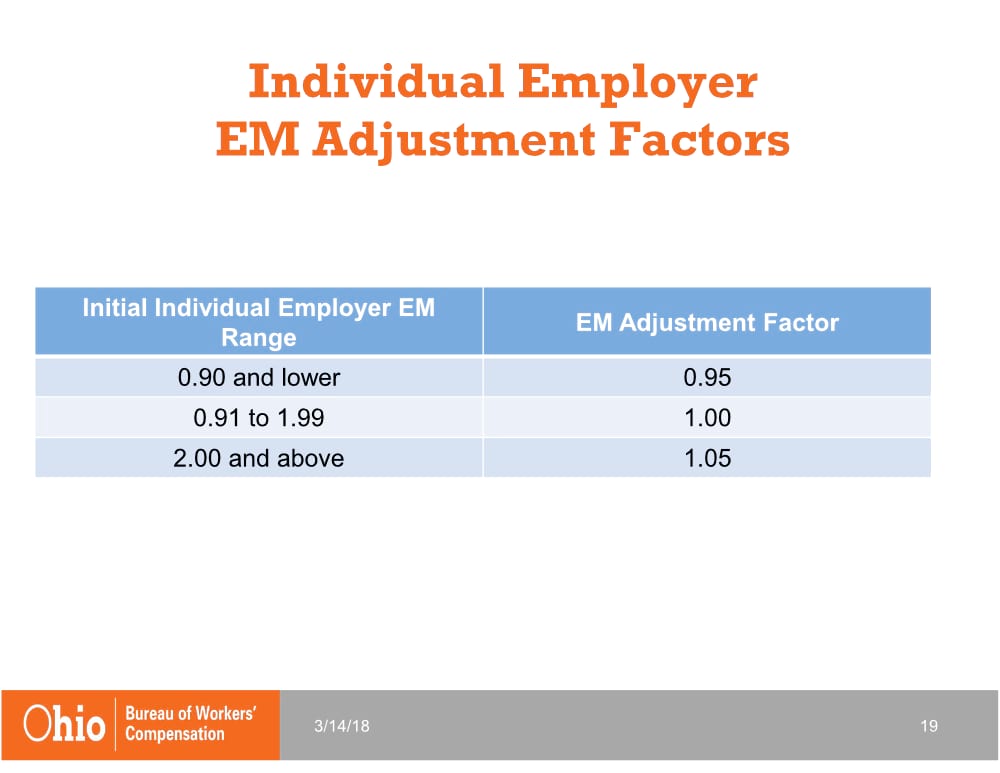

Individual Employer EM Adjustment Factors

The EMR adjustment factor. If you're not familiar with the EM, that is experience modifier, which is essentially your rate, how safe of a company are you based on your size and your industry. So, if you are a company that is credit rated at 0.9 or lower (so if your 10% credit) rated, or lower, you're going to see a 5% discount on your premium. If you are between a 0.91 and a 1.99 would mean you're 99% percent penalty rated, which means you're paying 99% more than the average company of your size and in your industry - you're not going to see any discount. And actually if you're above 2, meaning you're 100% or more worse than a company your size, you're going to get penalized. You’ll see a 5% ding in your premium. So, add insult to injury on that one.

The EMR adjustment factor. If you're not familiar with the EM, that is experience modifier, which is essentially your rate, how safe of a company are you based on your size and your industry. So, if you are a company that is credit rated at 0.9 or lower (so if your 10% credit) rated, or lower, you're going to see a 5% discount on your premium. If you are between a 0.91 and a 1.99 would mean you're 99% percent penalty rated, which means you're paying 99% more than the average company of your size and in your industry - you're not going to see any discount. And actually if you're above 2, meaning you're 100% or more worse than a company your size, you're going to get penalized. You’ll see a 5% ding in your premium. So, add insult to injury on that one.

Employers really want to be paying attention to these changes. They may be positively or negatively affected depending on their situation.

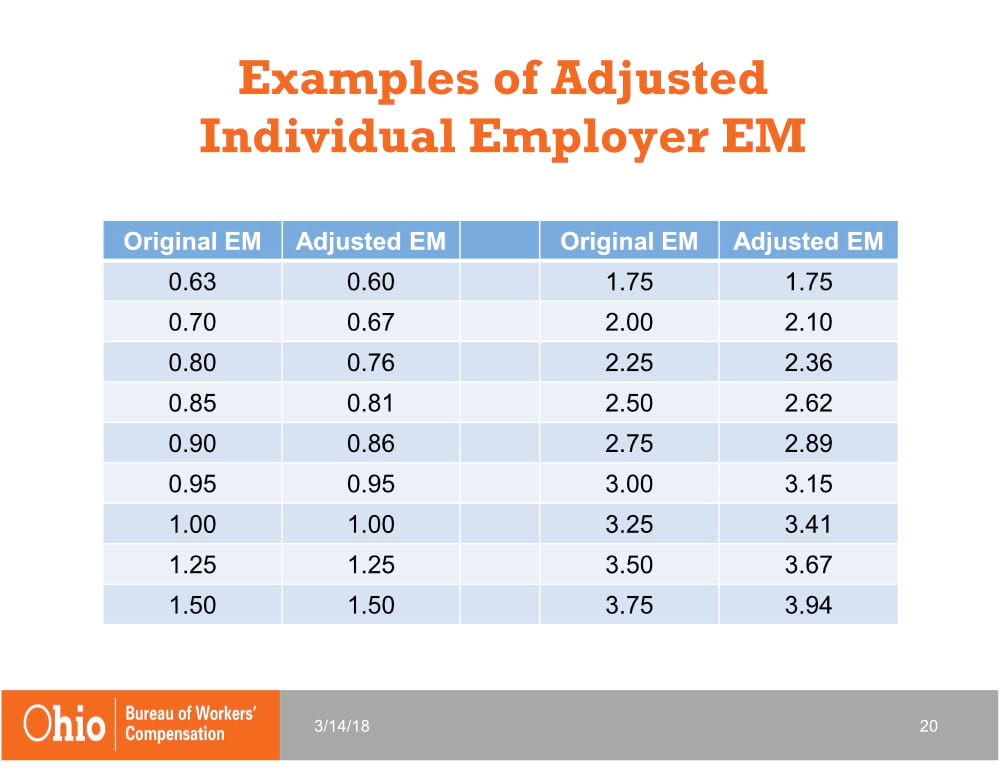

Examples of the EMR Adjustment Factor

Just some some quick examples. If you reference the image above and look at that first one, 0.63. You multiply that by .95. You'd end up at a .6. But then, once you start to get up to that 0.95, it's going to just start being multiplied by 1. Employers stay even on those.

Just some some quick examples. If you reference the image above and look at that first one, 0.63. You multiply that by .95. You'd end up at a .6. But then, once you start to get up to that 0.95, it's going to just start being multiplied by 1. Employers stay even on those.

And then, once you get the 2, you're going to see a 5% ding. So, at 1.05 times 2 is 2.1 since you're actually going to get dinged by essentially 10% , which can be significant to a lot of employers.

If you haven't had a conversation with your TPA about it, you can ask them, even if it's not Spooner. You really just should know where this money is coming from and how it's impacting you.

In Summary

In 2019, the Ohio Bureau of Workers' Compensation is making a lot of changes. It's a good idea to talk to your TPA about these changes and make sure you understand what's gonna be happening to you and your company.

For more information, you can request the free quote, contact us for information, or read about our services and find out how we can help you out. It's free and cost you nothing other than having to listen to us for about half an hour. You may come out of it really understanding you know more about your programs and how you're gonna be affected in the New Year.